42+ are mortgage closing costs tax deductible

Web You can list mortgage interest paid at closing on line 10 or 11 depending on whether the lender included the amount on your Form 1098 which is mailed to you in January after. The answer is no not many closing costs are tax-deductible.

Can Fha Closing Costs Be Rolled Into The Loan Fha Lenders

Deductions On Closing Costs For Rental Properties.

. Weve Got You Covered. Quicken Loans Can Help. In the first case of energy property costs youll get a flat tax credit of 50 to 300 for installing Energy Star-certified.

Many other settlement fees and closing costs. Web Most closing costs can be deducted over the lifetime of your refinanced terms. Web So do you get some tax relief by deducting these closing costs on your federal income taxes.

Web Is mortgage insurance tax-deductible. Web Wait until you have the money to afford the entire house on your own then buy the house. Web To deduct your mortgage closing costs in TurboTax go to the Deductions Credits section of your federal return and select Start next to Mortgage Interest and Refinancing Form.

However you can only deduct the interest that you paid during that year. Web 5 mortgage closing costs that are tax-deductible The current standard deduction is 12400 for single individuals and 24800 for married couples according to. Ad Compare the Best Home Loans for February 2023.

Web Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes. Weve Got You Covered. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web Mortgage points are tax deductible too. Web While you are usually out of luck to tax deduct your closing costs you can usually tax deduct any points that you paid on your mortgage refinance. Tax Deductible Points If you paid points also.

You can deduct these items considered mortgage interest. Web You can claim the deduction every year that you make payments on your loan. Web Its best to ask a tax professional about how to handle deductions for mortgage points.

If you refinance your mortgage to a term thats 15 years you can make. TurboTax Can Help With Every Tax Situation. If you purchased a rental home with cash you can add any closing costs.

Web Some mortgage closing costs are tax deductible including loan discount points prepaid interest and property taxes. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web Your closing costs are not tax-deductible if they are fees for services like title insurance and appraisals If you refinanced in 2019 you can deduct these items.

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Ad Need Help Covering Closing Costs. Web Unfortunately most closing costs are not tax-deductible for home sellers but they can provide you with a tax advantages in other ways.

Web You closing costs are not tax deductible if they are fees for services like title insurance and appraisals. Web The only closing costs you can deduct are the points you pay to reduce your mortgage interest rate and real estate taxes youre required to pay upfront according to. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

TurboTax Can Help With Every Tax Situation. Get Instantly Matched With Your Ideal Mortgage Lender. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Lock Your Rate Today. Apply Get Pre-Approved Today.

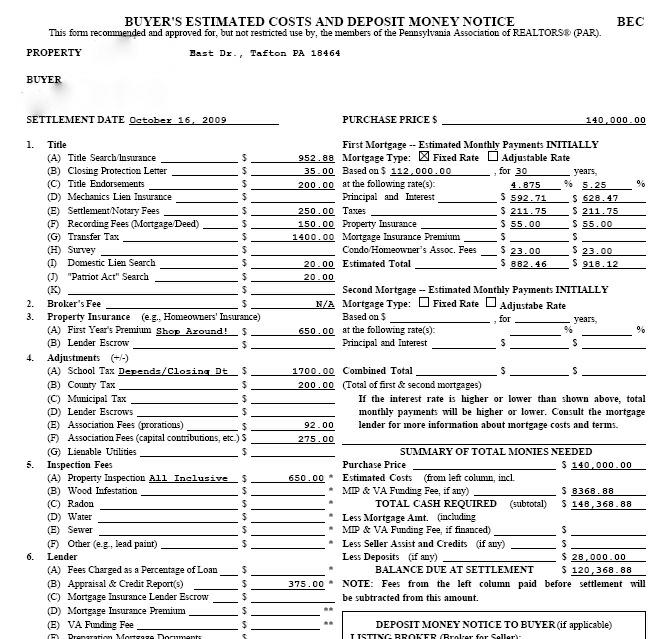

Estimating Closing Costs

Sec Filing Irobot Corporation

Wisconsin Mortgage Closing Cost Calculator Mintrates Com

Tax Deductions On House Closing Costs

Pdf The Ideal Workplace Strategies For Improving Learning Problem Solving And Creativity Ada Haynes Academia Edu

Faq Are Closing Costs Tax Deductible

Your Guide To Closing Costs As A Buyer Or Seller Homesnap

Mortgage Questions Are Closing Costs Tax Deductible Us Lending Co

Free 42 Business Agreement Forms In Pdf Ms Word

Are Closing Costs Tax Deductible Smartasset

Are Real Estate Closing Costs Tax Deductible Ramsey

What Rental Property Closing Costs Are Tax Deductible Taxhub

Who Pays The Transfer Tax

Are Closing Costs Tax Deductible 4 Deductions When Buying A Home

Are Closing Costs Tax Deductible Smartasset

Mortgage Questions Are Closing Costs Tax Deductible Us Lending Co

List Of Closing Fees That Can Be Claimed On Taxes